Historical Surge: 10% Gain, 3T Yuan Trade, 30% Daily Profit for Investors

The National Day holiday has come to an end, and the A-share market continues its wild performance!

On October 8th, the three major A-share indices collectively opened higher, with the Shanghai Composite Index up by 10.13%, the Shenzhen Component Index up by 12.67%, and the ChiNext Index up by 18.44%. Within just 20 minutes of the opening, the A-share turnover broke through 1 trillion yuan, setting the fastest record for a trillion in history.

As of the close, the turnover of the Shanghai and Shenzhen stock markets historically exceeded 3 trillion yuan for the first time, reaching 3.45 trillion yuan, a significant increase of over 800 billion yuan compared to September 30th before the holiday.

Almost all industry sectors rose, with semiconductors, software development, electronic chemicals, batteries, internet services, computer equipment, electronic components, instruments, aerospace, and consumer electronics sectors leading the gains, while only the hotel and catering, and coal sectors turned green against the market trend.

In addition, individual stocks continued the general upward trend, with more than 5,000 stocks rising in the market, 784 stocks hitting the daily limit up, and only 5 ST stocks hitting the daily limit down.

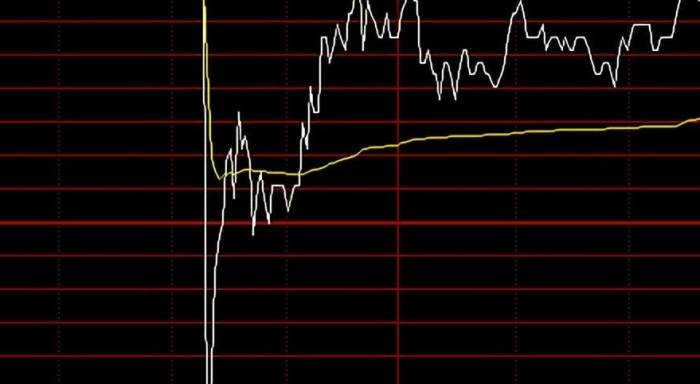

On October 8th, Yatai Group (600881) opened with a daily limit up and once plummeted to the daily limit down during the trading session, but it rebounded to close at the daily limit up again, with the stock price reported at 2.08 yuan, and a daily turnover of 900 million yuan.

Some investors exclaimed, selling at the daily limit up and buying at the daily limit down, making a 30% profit in a single day...

Data shows that since September 23rd, Yatai Group's stock price has hit the daily limit up for seven consecutive trading days, with a cumulative increase of over 96%...

Information indicates that Yatai Group was listed on the Shanghai Stock Exchange in 1995. After years of development, it has formed a business development pattern centered on building materials group, real estate group, pharmaceutical group, and financial investment, e-commerce, and commercial operation, making it the largest shareholder of Northeast Securities and a core shareholder of Jilin Bank.In terms of performance, from 2021 to 2023, Yatai Group achieved revenues of 19.65 billion yuan, 12.97 billion yuan, and 9.252 billion yuan, respectively, with net profits of -1.254 billion yuan, -3.43 billion yuan, and -3.947 billion yuan for the same periods, marking three consecutive years of losses.

Regarding the loss in 2023, Yatai Group explained that it was mainly due to the impact of multiple factors. The gross margin of the company's cement clinker and commercial concrete decreased significantly, leading to losses in the building materials industry. Additionally, the real estate industry is still in a deep adjustment phase, with the company's transferred project gross margins remaining low, resulting in losses in the real estate industry. Furthermore, the company provided for asset impairment losses on building materials and real estate projects showing signs of impairment.

It is worth noting that since 2018, the company's net profit attributable to non-recurring gains has been negative for six consecutive years...

In the first half of 2024, Yatai Group achieved a revenue of 2.929 billion yuan, a year-on-year decrease of 37.74%, and a net profit of -0.927 billion yuan. This was still due to the overall low gross margin of the company's building materials products, the low gross margin of the real estate transferred projects, and the significant decrease in investment income compared to the same period last year.

Leave a Reply