Possible End to Rate Cuts; $36T May Withdraw

The Fed suddenly changes its face, and $36 trillion may be about to flee! Wall Street bigwigs: The most terrifying moment is coming.

Do you remember the Fed last week that confidently said it would cut interest rates?

Ha, they changed their minds again.

Just as global investors were looking forward to the long-awaited interest rate cut in November, the Fed suddenly made a 180-degree turn, transforming from a gentle dove to a fierce hawk overnight.

This dramatic twist not only caught Wall Street off guard but also dropped a "deep-water bomb" into the global financial market.

Behind all this, there may be a shocking conspiracy hidden...

The Fed's double-faced dance

Do you remember what the Fed officials said last week?

"Inflation is decreasing, the economy is growing, and the job market is strong."

"We need to continue cutting interest rates.""Market expectations are correct, and we will meet your expectations."

How gentle and considerate it sounds! It's like being the confidant of investors.

But in the blink of an eye, the wind has changed.

On the evening of October 10th, after the release of the September CPI data, the Federal Reserve suddenly sent out their "hawk king" Bostic.

This usually low-profile Atlanta Fed chairman, as soon as he opened his mouth, gave the market a blow:

"I am completely at ease about skipping a rate cut in November."

"The latest data provides a basis for pausing rate cuts."

Hey, this is not the right style!

What's more deadly is that Federal Reserve Chairman Powell seems to be manipulating all this behind the scenes. The reporter known as the "new Fed mouthpiece" cited Bostic's views the next day, but did not mention other officials who support rate cuts.

What is this for? It's obviously paving the way for not cutting interest rates in November in advance!Wall Street Titans: The Scariest Moment Has Arrived

Faced with the sudden change of heart from the Federal Reserve, Wall Street titans are getting restless.

Former U.S. Treasury Secretary Larry Summers warned: "Don't be deceived by the September employment data; an economic recession is on the horizon."

The "Wall Street Prophet" Peter Schiff made an even more astonishing statement: "The Federal Reserve is about to make a significant policy mistake. When the recession comes, inflation will make a comeback, which will crush the dollar and U.S. Treasury bonds."

Most frighteningly, Summers also said: "The only thing that worries me now is that people on Wall Street no longer know what fear is."

With the bigwigs speaking out like this, can the retail investors not panic?

$36 Trillion on the Brink

Don't think that only retail investors are worried; the big players have already started to take action.

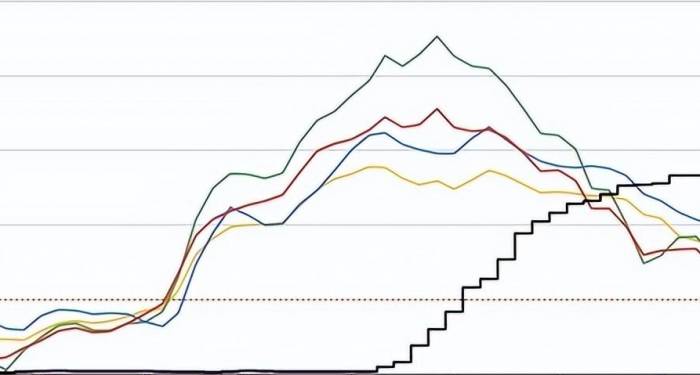

It is reported that as much as $36 trillion in international funds are preparing to withdraw from the U.S. market. This includes U.S. Treasury bonds, securities, real estate, and even bank deposits!

Even "Stock God" Warren Buffett has taken the lead in liquidating his holdings in U.S. bank stocks. Can you say it's not terrifying?What's more alarming is that the risk of default on U.S. sovereign debt is soaring. Data from Goldman Sachs shows that the price of U.S. five-year credit default swaps (CDS) has risen above 37 basis points, reaching a new high since last June.

What does this mean? It means that the bigwigs on Wall Street have already started buying insurance for U.S. Treasury bond defaults!

A conspiracy by the Federal Reserve?

So the question arises, why would the Federal Reserve do this?

Some analysts believe that this could be a meticulously designed "harvest game" by the Federal Reserve.

Think about it, first send out dovish signals to lure investors to bet on interest rate cuts. Once everyone is on board, suddenly make a sharp turn and not cut rates, wouldn't that be a way to harvest a wave of retail investors?

What's even scarier is that doing so can also prevent large-scale capital outflows from the U.S. market. After all, no one knows exactly what the Federal Reserve will do next, so it's better to wait and see.

What should ordinary people do?

Faced with such a complex situation, what should we ordinary investors do?

Do not blindly follow the crowd. Remember, the rules of the game on Wall Street can change at any time.Diversify your investments. Don't put all your eggs in one basket, especially when it comes to dollar-denominated assets.

Pay attention to the real economy. During financial market turmoil, the real economy tends to be more stable.

Improve financial literacy. Learn more and think more to protect yourself in the storm.

Maintain cash reserves. Cash is king, a principle that applies at all times.

Finally, let's end today's sharing with a quote from a Wall Street tycoon:

"Fear when others are greedy, and be greedy when others are fearful."

Friends, are you greedy or fearful now?

Leave a Reply